You are here: Home / Insurance Planning / HDFC Life Sanchay – Reality check of 8% to 9% Guaranteed Addition HDFC Life Sanchay – Reality check of 8% to 9% Guaranteed Addition

HDFC Life Sanchay claims 8% to 9% Guaranteed Addition and also the guaranteed maturity benefit of 220% to 325% of the Sum Assured depending upon the policy term. One of my blog readers noticed this and shared with me for review. Let us see the what is the truth.

It is one of the traditional plans which is not related to stock market. In such a situation how can a product generate 8% to 9% GUARANTEED ADDITION?

Let us see the key plan features. They are listed as below.

- Guaranteed benefits payable on maturity provided all due premiums have been paid.

- Guaranteed benefits will vary by policy term in a range of 220% to 325% of the Sum Assured on Maturity.

- Premium payment for a limited period of 5, 8 and 10 years.

- Flexibility to choose policy terms ranging from 15 years to 25 years.

Eligibility to buy HDFC Life Sanchay

Below are the eligibility conditions to buy this product.

HDFC Life Sanchay Benefits

# Guaranteed Additions (GA)

The plan offers guaranteed additions as a percentage of Sum Assured on Maturity accrued at a simple rate for each completed policy year, throughout the policy term.

These Guaranteed Additions are payable at Maturity or Death whichever is earlier, subject to all due premiums being paid. In case of surrender, the surrender value of Guaranteed Additions will be payable.

Policy Term-15 Yrs to 19 Yrs-GA 8%.

Policy Term-20 Yrs to 25 Yrs-GA-9%.

# Maturity Benefit

If policyholder survives till the end of the policy period, then he will receive the below benefits.

Sum Assured on Maturity (which is equal to Basic Sum Assured)+ Accrued Guaranteed Additions. This according to HDFC Life varies from 220% for 15 Years policy to 325% for 25 years policies of Sum Assured.

# Death Benefit

If the death of the policyholder occurs during the policy period, then his nominee will receive below benefits.

Sum Assured on death is higher of the below.

a) Sum Assured on Maturity

b) an absolute amount assured to be paid on death, which in this case is equal to the Sum Assured on Maturity

c) 105% of premiums paid

d) 10 times Annualised Premium

HDFC Life Sanchay – Reality check of 8% to 9% Guaranteed Addition

As I said earlier, two things are highlighted by HDFC Life to sell this product. The first one is 8% to 9% Guaranteed Addition and second is Guaranteed maturity benefit of 220% to 325% of the Sum Assured depending upon the policy term.

Let us check the reality now. For this purpose, I took the same example of what they showed in their product brochure.

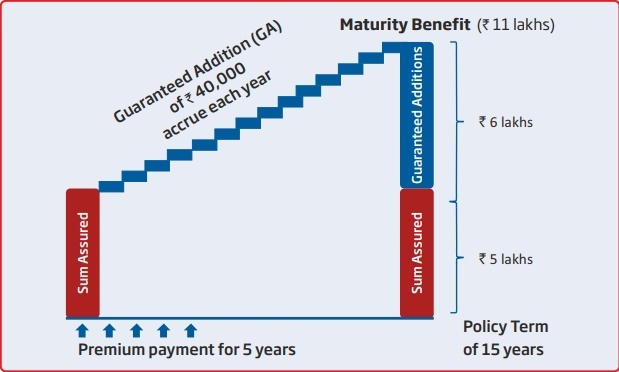

Ramesh, a 35-year-old individual, invests Rs. 1,14,877 annually for 5 years in the HDFC Life Sanchay. He chooses a policy term of 15 years. His Sum Assured on Maturity in the plan is Rs.5,00,000. He will receive a guaranteed maturity benefit of Rs.11,00,000 at the end of the policy term. Below table illustrates his benefits in the plan.

Now as per HDFC Life ‘s claim, Ramesh will definitely receive 8% GA per year without fail till maturity. Also, the maturity benefit is obviously 220% of Sum Assured.

So is it a GREAT product? Let us cross-check the reality by using the IRR formula and find out the actual returns from this plan.

You noticed that the actual returns are just 5.11% but not the 8% to 9%. Then why returns showing less?

# The premium in this plan is hefty but sum assured is less. Hence, the returns are less. Because your returns are linked to the sum assured you opted.

# The GA what HDFC Life will declare yearly will not earn any interest further. They just keep that money with them and will pay you back either at maturity or death.

# Even though 8% or 9% GA and 220% to 325% of Sum Assured at maturity will look fancy, but the reality is that this plan not gives you more than 6% returns.

Conclusion:–

The 8% and 9% GUARANTEED ADDITION may look you fancy to jump into investment. But when you check the return on investment, then you will see that returns are not more than 6%.

Also, one more fancy thing what HDFC Life did is that to claim 220% to 325% of Sum Assured as a maturity benefit. This at first glance looks so attractive. But the reality is something different.

MORE WILL UPDATE SOON!!

Comments

Post a Comment